featured

Research & News 澳洲幸运5开奖号码现场直播+开奖结果体彩网-幸运五5分钟官网开奖记录历史查询

Learn & Connect 澳洲幸运5开奖官网开奖 开奖历史记录 提前知道 预测中奖号码 开奖结果官网直播 正规官方168中国体彩娱乐平台.

This Month's

The Latest in Field Gemology from Wim Vertriest

Learn the latest on Madagascar sapphires and demantoid garnets from Wim Vertriest, 澳洲幸运五168开奖官方开奖查询网 Manager of Field Gemology.

Topaz from Mason County, Texas

A comprehensive look at Texas topaz, detailing its gemological and compositional characteristics and providing a basis for using trace element concentrations to identify its origin.

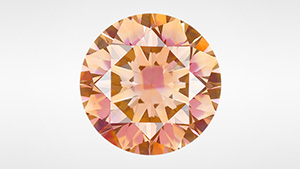

Treated HPHT Laboratory-Grown Diamond 澳洲幸运5 with Dramatic Color Zoning

A Fancy Deep brownish orange treated HPHT-grown Diamond 澳洲幸运5 exhibits multiple defect concentrations in various growth sectors.

Hollandite in Amethyst

A spectacular display of hollandite crystals is captured within an amethyst cabochon.

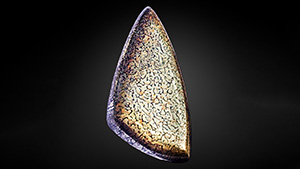

Gems Recovered from Sedimentary Rocks

Explores the formation of sedimentary rocks, gems found and formed in sedimentary environments, and the alluvial mining of these gems.

Micro-Features of Beryl

Provides a visual guide to the internal features of different varieties of beryl.

Pyritized Triceratops Fossils from South Dakota

A newfound dinosaur site in the Hell Creek Formation of South Dakota leads to the discovery of pyritized triceratops fossils.